Married Filing Separately 2025 Tax Bracket. For individuals, 3.8% tax on the lesser of: Head of household income range:

For the 2025 tax year, for which you’ll file in 2025, tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37% based on taxable income and filing status. There are a number of.

For the 2025 tax year, for which you’ll file in 2025, tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37% based on taxable income and filing status.

Irs Tax Brackets 2025 Married Jointly Latest News Update, Page last reviewed or updated: You would fall into the “more than $47,150” bracket and.

Married Filing Separate and N400 Applications CitizenPath, There are a number of. For tax year 2025, or the taxes you file in april 2025, these are the tax brackets and income thresholds for the various filing statuses:

Married Filing Separately When Does it Make Sense? • Benzinga, Page last reviewed or updated: Depending on your federal income tax bracket.

What Are The Capital Gains Tax Brackets For 2025 Latest News Update, The federal income tax has seven tax rates in 2025: 10%, 12%, 22%, 24%, 32%, 35% and 37%.

/https://blogs-images.forbes.com/learnvest/files/2015/03/531887071-1940x1295.jpg)

Married Filing Jointly Vs. Separately A CPA Weighs In, For the 2025 tax year, for which you’ll file in 2025, tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37% based on taxable income and filing status. You would fall into the “more than $47,150” bracket and.

.png?format=1000w)

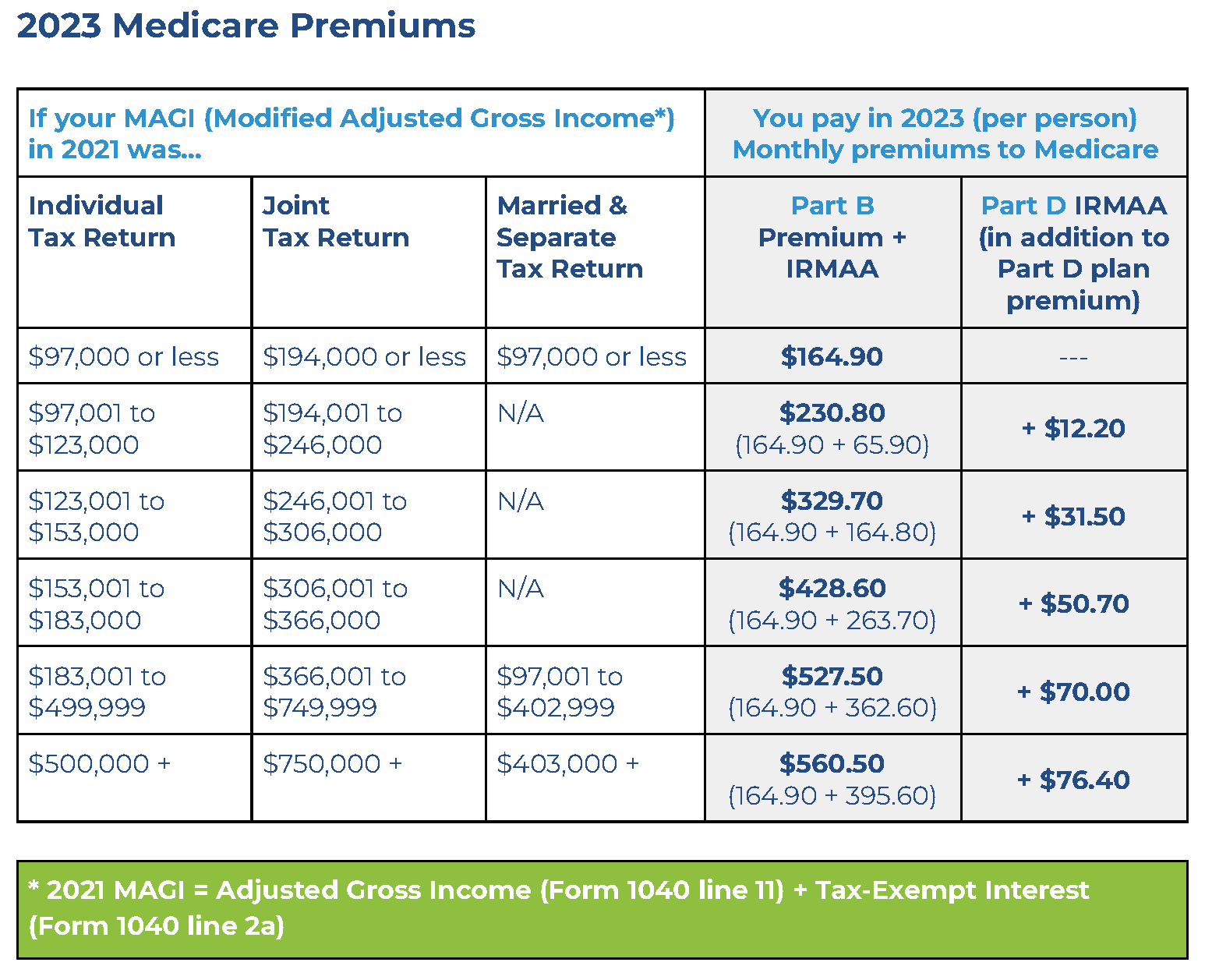

Why Filing Taxes Separately Could Be A Big Mistake (when on Medicare, For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly). We've got all the 2025 and 2025 capital gains tax rates in one place.

2025 Us Tax Brackets Irs Rezfoods Resep Masakan Indonesia, 8 rows all features, services, support, prices, offers, terms and conditions are subject to change without notice. The 2025 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons:

Tax Rates Sunset in 2026 and Why That Matters Barber Financial Group, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. The calculator below can help estimate the financial impact of filing a joint tax return as a married couple (as opposed to filing separately as singles) based on 2025 federal.

2025 marginal brackets RebekkaLucario, For individuals, 3.8% tax on the lesser of: There are seven tax rates for the 2025 tax season:

Tax Brackets Definition, Types, How They Work, 2025 Rates, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. (1) net investment income, or (2) magi in.

Tax brackets will be increased by 5.4% for each type of filer for 2025, including those filing separately or as married couples.